In the market

Assets under management

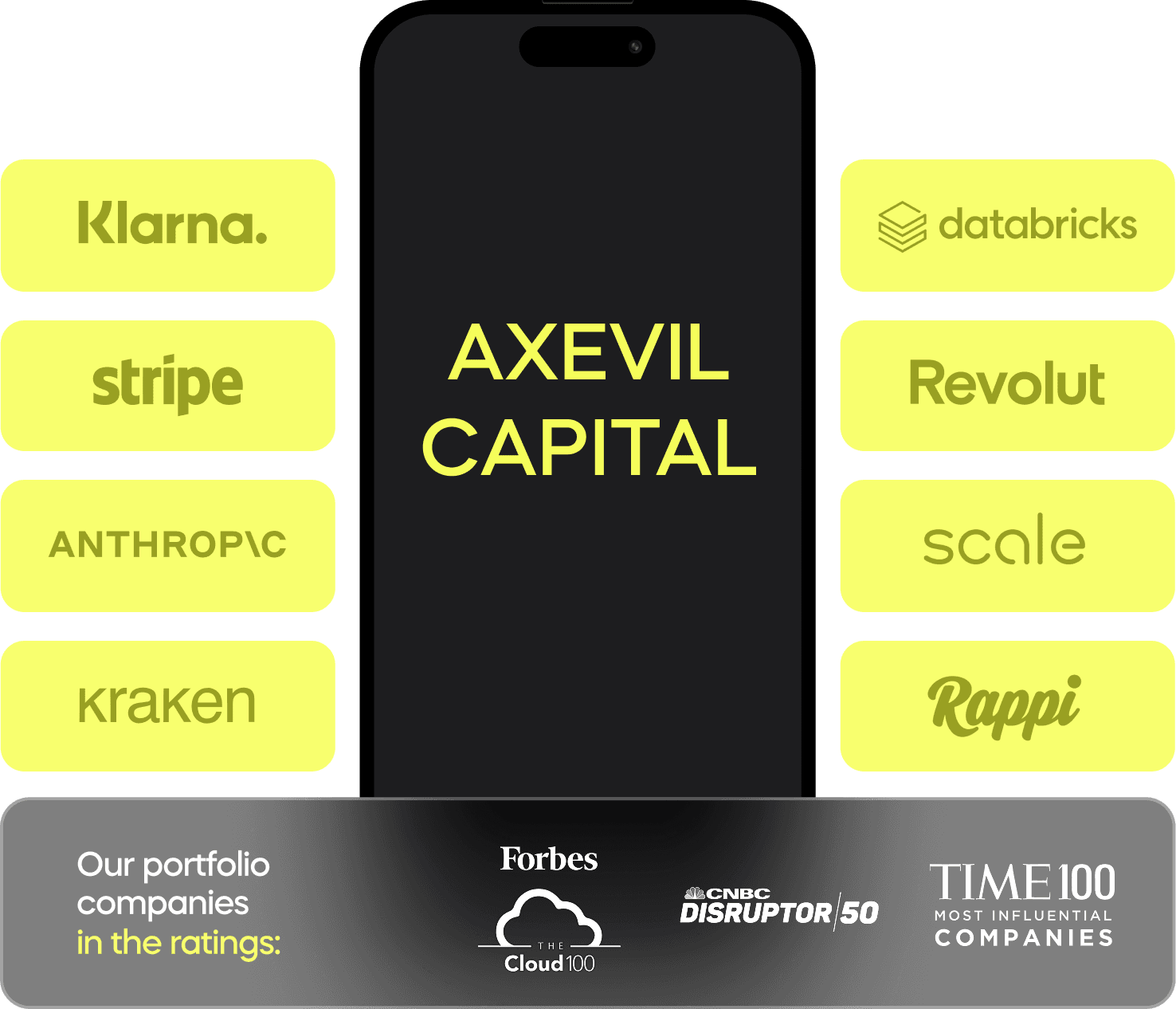

Сompanies in the portfolio

Focus on Pre-IPO Technology Leaders

Balanced Growth Potential and Risk

Risk and Potential Balance

Pre-IPO company investments can combine high growth potential with lower volatility compared to earlier-stage investments.

Late-Stage Resilience

Late-stage companies already have proven products, revenue, and sustainable business models, reducing the probability of failure compared to early-stage startups.

Portfolio Diversification

Adding Pre-IPO deals to your portfolio helps reduce dependence on public market fluctuations and complements long-term growth strategies.

Investment Horizon

Pre-IPO deals involve participation in companies considering public offerings within several years, depending on market conditions and corporate strategies.

Expert Partner Support at Every Stage

We'll provide information, answer questions, and conduct client presentations together.

Choose trend and industry leaders from 2,000+ late-stage companies

Systematically assess IPO probability within the next 1-3 years

Consider factors affecting company success before and after going public

Invest in world-changing industries: AI, Blockchain, BigTech

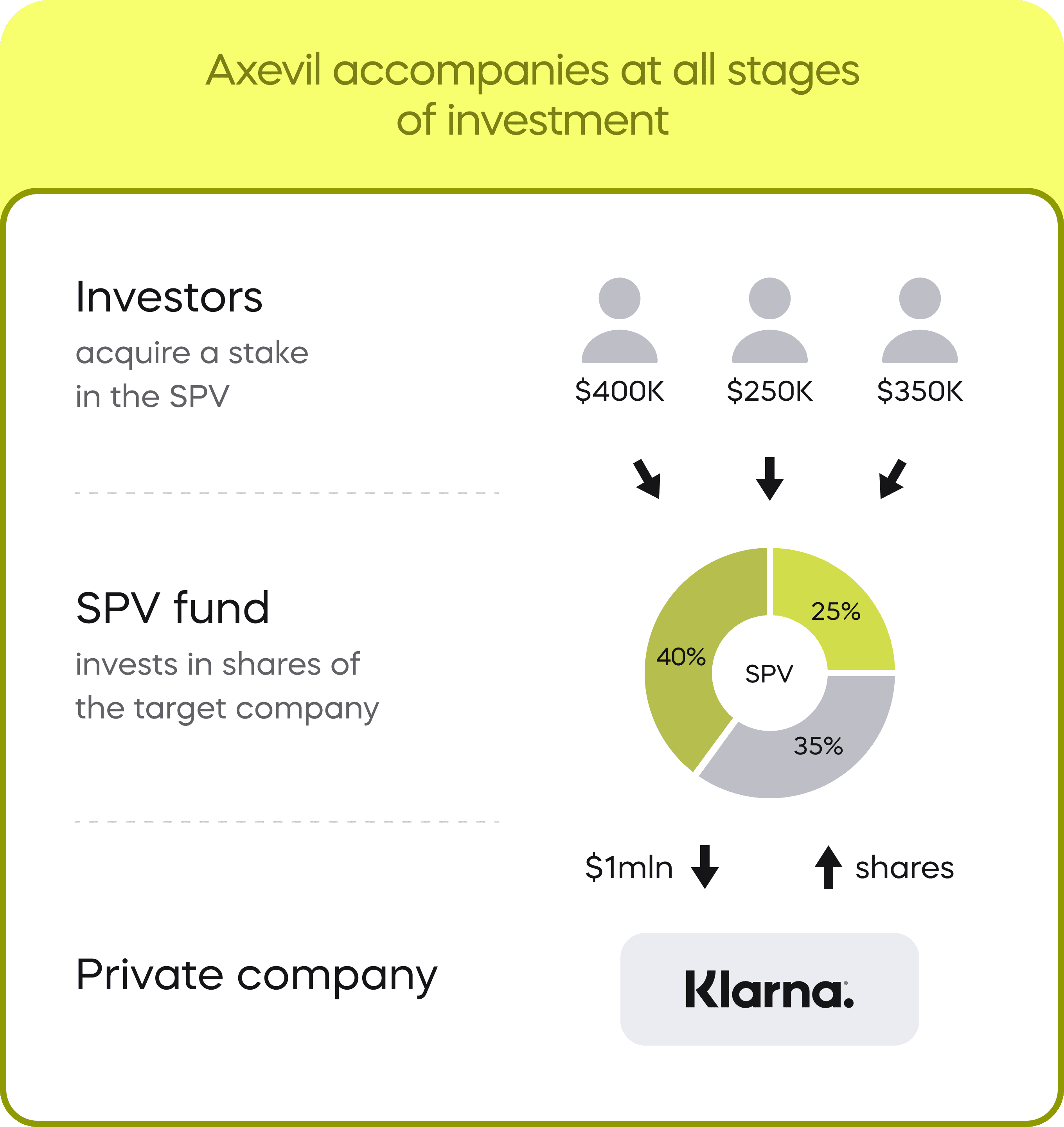

For each investment, a separate US company (SPV) is created, ensuring segregated asset accounting and structural transparency. This model is designed for international investors and helps avoid double taxation.

Offerings are conducted in compliance with US law and SEC requirements under private placement regulations for accredited investors (Reg D 506b).

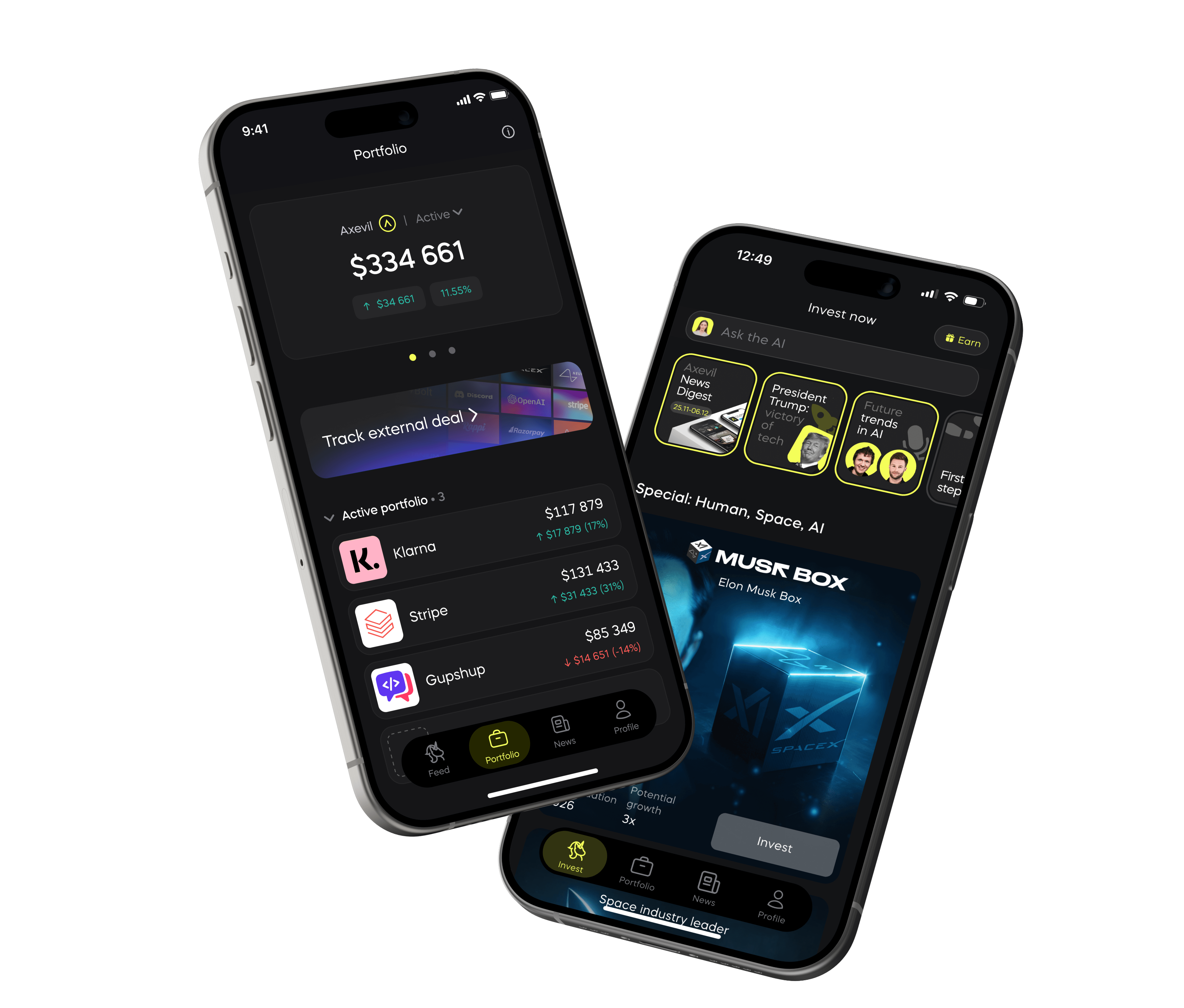

Axevil Capital Client App:

Electronic deal processing

Venture portfolio tracker

Market and portfolio company news

Partner Ecosystem:

Personal manager, regular events

Partner dashboard with deal status and reports

Deal room: materials and investment case details

Private partner Telegram channel

Our Partners

FAQ

Our Professional Team

Alexander Ivanov

Co-Founder and Managing Partner

Alexander Ivanov

12+ years of investment banking experience. Previously at Finam, Otkritie, and Aton. Led wealth management development initiatives.

Taras Chumachenko

Co-Founder and Managing Partner

Taras Chumachenko

10+ years of experience in alternative investments. Held senior positions at Societe Generale, managing investment products.

Vladislav Solovev

Senior Investment Analyst

Vladislav Solovev

5+ years of experience analyzing companies across private and public markets. Member of Angel Squad, the largest angel investor community in the US.

Andrey Revenko

Chief Commercial Officer

Andrey Revenko

Strategic capital management expert focused on HNW/UHNW segments. Former CEO of Kalinka Middle East (MENA real estate). 10+ years developing private banking at leading investment firms — BCS Ultima, ATON, and Troika Dialog.

Danil Yakovlev

Chief Product Officer

Danil Yakovlev

Product Lead with 10 years of experience in investments and fintech. Specialist in developing digital products for investors, enhancing user experience, and implementing data-driven solutions.

Artem Duz

Chief Technology Officer

Artem Duz

CTO with 15 years of experience across digital agencies, telecommunications, and brokerage firms. Expert in building scalable systems, agile processes, and AI implementation for digital business transformation.

Anna Babak

Chief Operating Officer

Anna Babak

COO with 5+ years of investment banking experience, including Special Situations. Expert in operational infrastructure, risk management, and resource allocation for sustainable growth.

Georgy Manasov

Chief Content Officer

Georgy Manasov

Content creation expert with 7+ years of experience in investments and capital management. End-to-end content development from concept to execution, text to video. Focused on quality and brand strategy alignment.

Pavel Rasputin

Chief Marketing Officer

Pavel Rasputin

Marketing professional with 15+ years of B2B and B2C experience. Helps startups scale and experienced teams optimize performance through deep customer insights and data-driven approaches.

And 25+ dedicated professionals

delivering market-leading service for you and your clients

Alexander Ivanov

Co-Founder and Managing Partner

Alexander Ivanov

12+ years of investment banking experience. Previously at Finam, Otkritie, and Aton. Led wealth management development initiatives.

Taras Chumachenko

Co-Founder and Managing Partner

Taras Chumachenko

10+ years of experience in alternative investments. Held senior positions at Societe Generale, managing investment products.

Vladislav Solovev

Senior Investment Analyst

Vladislav Solovev

5+ years of experience analyzing companies across private and public markets. Member of Angel Squad, the largest angel investor community in the US.

Andrey Revenko

Chief Commercial Officer

Andrey Revenko

Strategic capital management expert focused on HNW/UHNW segments. Former CEO of Kalinka Middle East (MENA real estate). 10+ years developing private banking at leading investment firms — BCS Ultima, ATON, and Troika Dialog.

Danil Yakovlev

Chief Product Officer

Danil Yakovlev

Product Lead with 10 years of experience in investments and fintech. Specialist in developing digital products for investors, enhancing user experience, and implementing data-driven solutions.

Artem Duz

Chief Technology Officer

Artem Duz

CTO with 15 years of experience across digital agencies, telecommunications, and brokerage firms. Expert in building scalable systems, agile processes, and AI implementation for digital business transformation.

Anna Babak

Chief Operating Officer

Anna Babak

COO with 5+ years of investment banking experience, including Special Situations. Expert in operational infrastructure, risk management, and resource allocation for sustainable growth.

Georgy Manasov

Chief Content Officer

Georgy Manasov

Content creation expert with 7+ years of experience in investments and capital management. End-to-end content development from concept to execution, text to video. Focused on quality and brand strategy alignment.

Pavel Rasputin

Chief Marketing Officer

Pavel Rasputin

Marketing professional with 15+ years of B2B and B2C experience. Helps startups scale and experienced teams optimize performance through deep customer insights and data-driven approaches.

And 25+ dedicated professionals

delivering market-leading service for you and your clients