Building the Future of Private Equity

Digital Platform for Professional Investors and Wealth Managers

Axevil Capital — VC Platform for Pre-IPO Investments

Our mission:

Providing access to investments in the largest private technology companies—the leaders in their sectors.

Investment focus:

AI, FinTech, Consumer Tech, B2B SaaS

Geography:

US, India, Emerging Markets

In the market

Сompanies in the portfolio

Active clients

Assets under management

Our Portfolio

30+ tech companies in the US, India, and across emerging marketsConfluent

The global leader in data streaming

Anthropic

The cutting-edge Al company

Circle

The USDC issuer

Scale AI

The backbone of Al data infrastructure

Kraken

The global US-based crypto exchange

SpaceX

The leader in private space exploration

Toss

The next-gen personal finance ecosvstem

Automation Anywhere

The future of business process automation

Rappi

The ultimate on-demand delivery platform in LatAm

Betr

Next-gen sports betting platform

Uzum

The largest superapp of Uzbekistan

Glean

AI‑powered enterprise search software

Klarna

The pioneer of flexible e-com payments

Stripe

The infrastructure for global payments

Databricks

The unified platform for data and Al

Revolut

The all-in-one global finance platform

Bolt Financial

The pioneer in one-click checkout

Consensys

The global leader in blockchain solutions

Byju's

The innovator in tech-driven education in India

Razorpay

The powerhouse of modern payments in India

Gupshup

The India's leader in conversational messaging tech

Netskope

A provider of network security solutions

Blockchain.com

One of the world's largest platforms for digital assets

Blockdaemon

The engine powering blockchain infrastructure

Confluent

The global leader in data streaming

Anthropic

The cutting-edge Al company

Circle

The USDC issuer

Scale AI

The backbone of Al data infrastructure

Kraken

The global US-based crypto exchange

SpaceX

The leader in private space exploration

Toss

The next-gen personal finance ecosvstem

Automation Anywhere

The future of business process automation

Rappi

The ultimate on-demand delivery platform in LatAm

Betr

Next-gen sports betting platform

Uzum

The largest superapp of Uzbekistan

Glean

AI‑powered enterprise search software

Klarna

The pioneer of flexible e-com payments

Stripe

The infrastructure for global payments

Databricks

The unified platform for data and Al

Revolut

The all-in-one global finance platform

Bolt Financial

The pioneer in one-click checkout

Consensys

The global leader in blockchain solutions

Byju's

The innovator in tech-driven education in India

Razorpay

The powerhouse of modern payments in India

Gupshup

The India's leader in conversational messaging tech

Netskope

A provider of network security solutions

Blockchain.com

One of the world's largest platforms for digital assets

Blockdaemon

The engine powering blockchain infrastructure

Axevil Capital Cases

Key corporate developments at our portfolio companies

Circle: NASDAQ IPO

Circle is the issuer of USDC, the world's second-largest stablecoin. In March 2025, we invested in the company, and by summer 2025, a successful NASDAQ IPO took place with 25x oversubscription. Shares were sold after 6 months.

Confluent: IPO on the NASDAQ

Confluent is a leader in data streaming. We invested in March 2021. The company completed a successful Nasdaq IPO in the summer, and the shares were sold six months later.

Scale AI: Strategic Deal with Meta

We invested in Scale AI before its valuation step-up. In May 2024, the company secured $1B at a $13.8B valuation, doubling our position’s value.

Databricks: Growth from $26B to $100B

We invested in Databricks in the summer of 2023 at a $26B valuation. Three months later, the company announced a new funding round at a $43B valuation. In August 2025, Databricks signed a term sheet for a Series K round valuing the company at over $100B.

Stripe: Secondary Market and IPO Plans

In 2023, we acquired Stripe shares at a $52.5B valuation. In 2024–2025, secondary market transactions priced the company at over $80B. The company is considering an IPO in 2025–2026.

Klarna: US IPO at a $14B Valuation

We invested in Klarna in 2022 at a $6.7B valuation. In 2025, the company filed with the SEC and plans to list on the NYSE, raising approximately $1.27B at a $14B valuation.

Uzum: The Next Digital Leader in Central Asia

Uzum is building the largest fintech ecosystem in Central Asia, covering more than 50% of Uzbekistan’s population. In August 2025, the company raised $70M from Tencent, VR Capital, and other investors at a valuation of $1.5B and is considering an IPO in 2027.

Circle: NASDAQ IPO

Circle is the issuer of USDC, the world's second-largest stablecoin. In March 2025, we invested in the company, and by summer 2025, a successful NASDAQ IPO took place with 25x oversubscription. Shares were sold after 6 months.

Confluent: IPO on the NASDAQ

Confluent is a leader in data streaming. We invested in March 2021. The company completed a successful Nasdaq IPO in the summer, and the shares were sold six months later.

Scale AI: Strategic Deal with Meta

We invested in Scale AI before its valuation step-up. In May 2024, the company secured $1B at a $13.8B valuation, doubling our position’s value.

Databricks: Growth from $26B to $100B

We invested in Databricks in the summer of 2023 at a $26B valuation. Three months later, the company announced a new funding round at a $43B valuation. In August 2025, Databricks signed a term sheet for a Series K round valuing the company at over $100B.

Stripe: Secondary Market and IPO Plans

In 2023, we acquired Stripe shares at a $52.5B valuation. In 2024–2025, secondary market transactions priced the company at over $80B. The company is considering an IPO in 2025–2026.

Klarna: US IPO at a $14B Valuation

We invested in Klarna in 2022 at a $6.7B valuation. In 2025, the company filed with the SEC and plans to list on the NYSE, raising approximately $1.27B at a $14B valuation.

Uzum: The Next Digital Leader in Central Asia

Uzum is building the largest fintech ecosystem in Central Asia, covering more than 50% of Uzbekistan’s population. In August 2025, the company raised $70M from Tencent, VR Capital, and other investors at a valuation of $1.5B and is considering an IPO in 2027.

Benefits of Investing with Us

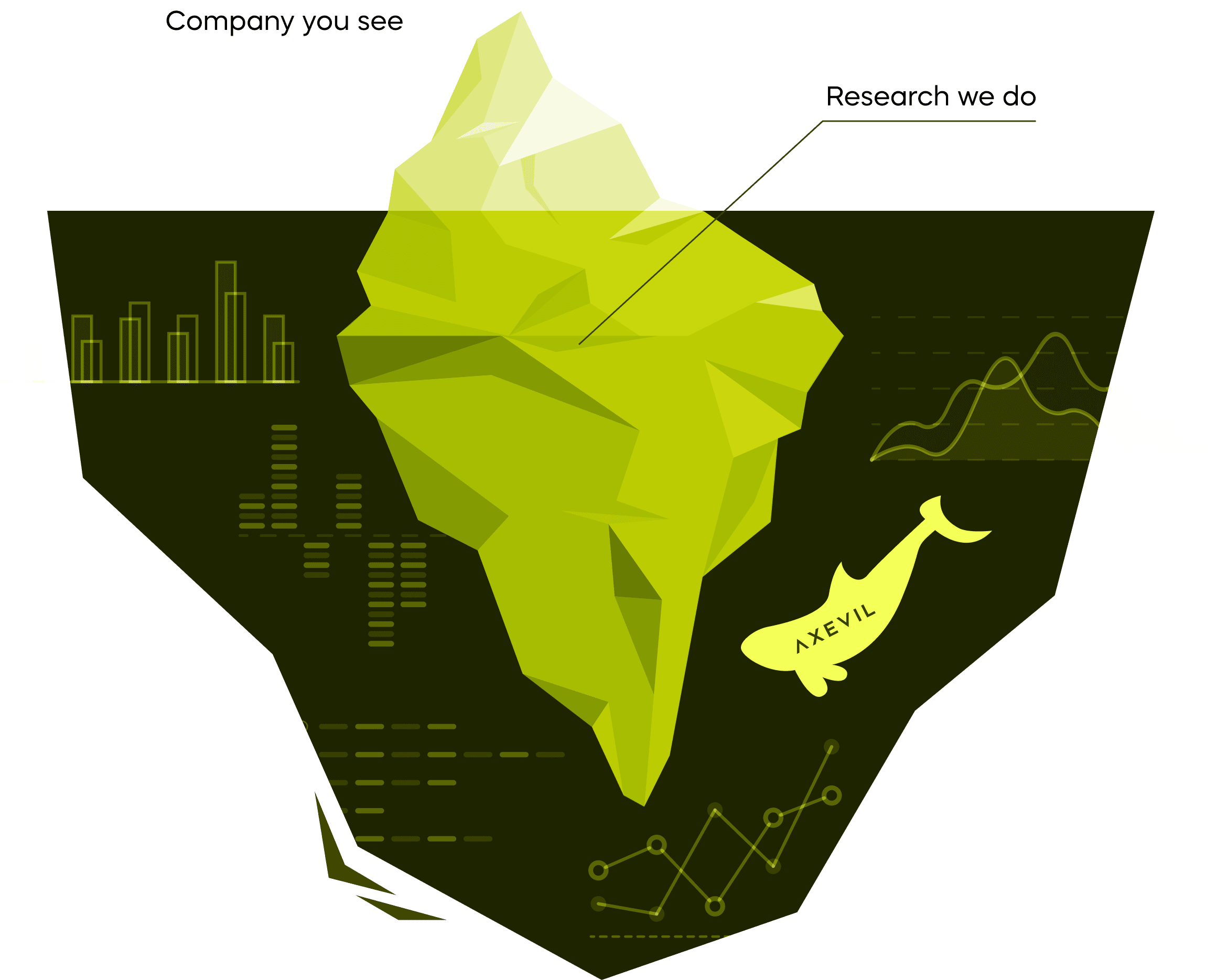

1/ Rigorously Selected Late-Stage Companies

We select late-stage companies with high growth potential and apply a multi-tier screening process to reduce company-specific risks for investors:

IPO horizon of 1-3 years

Sustainable business model and market leadership potential

Transparent ownership structure

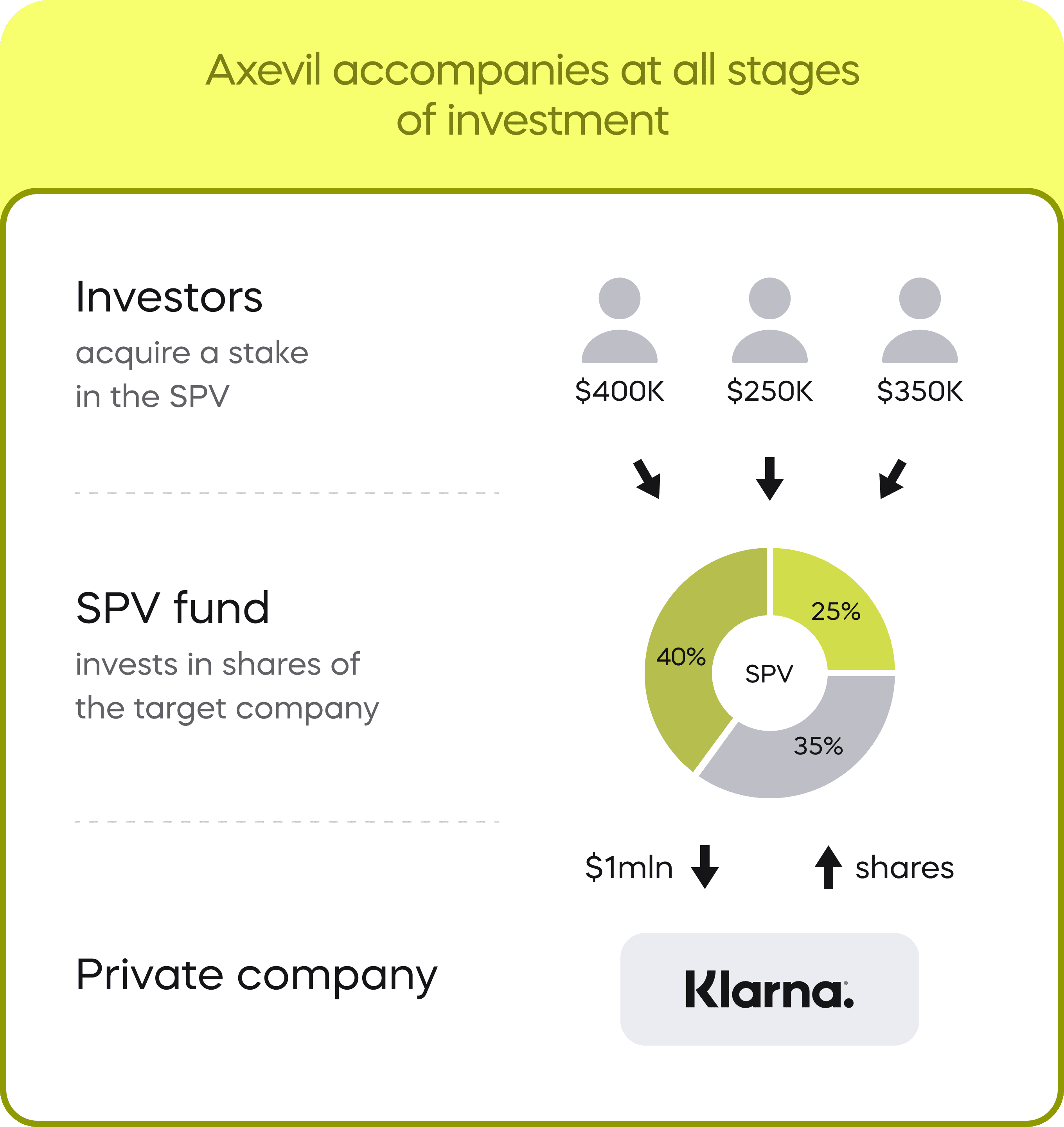

2/ Legal Structure to Protect Investor Interests

Each investment is structured through a separate US SPV (Special Purpose Vehicle), ensuring segregated asset management and structural transparency. This model is designed for international investors and helps avoid double taxation.

All offerings are conducted in compliance with US law and SEC requirements under private placement regulations for accredited investors (Reg D 506b).

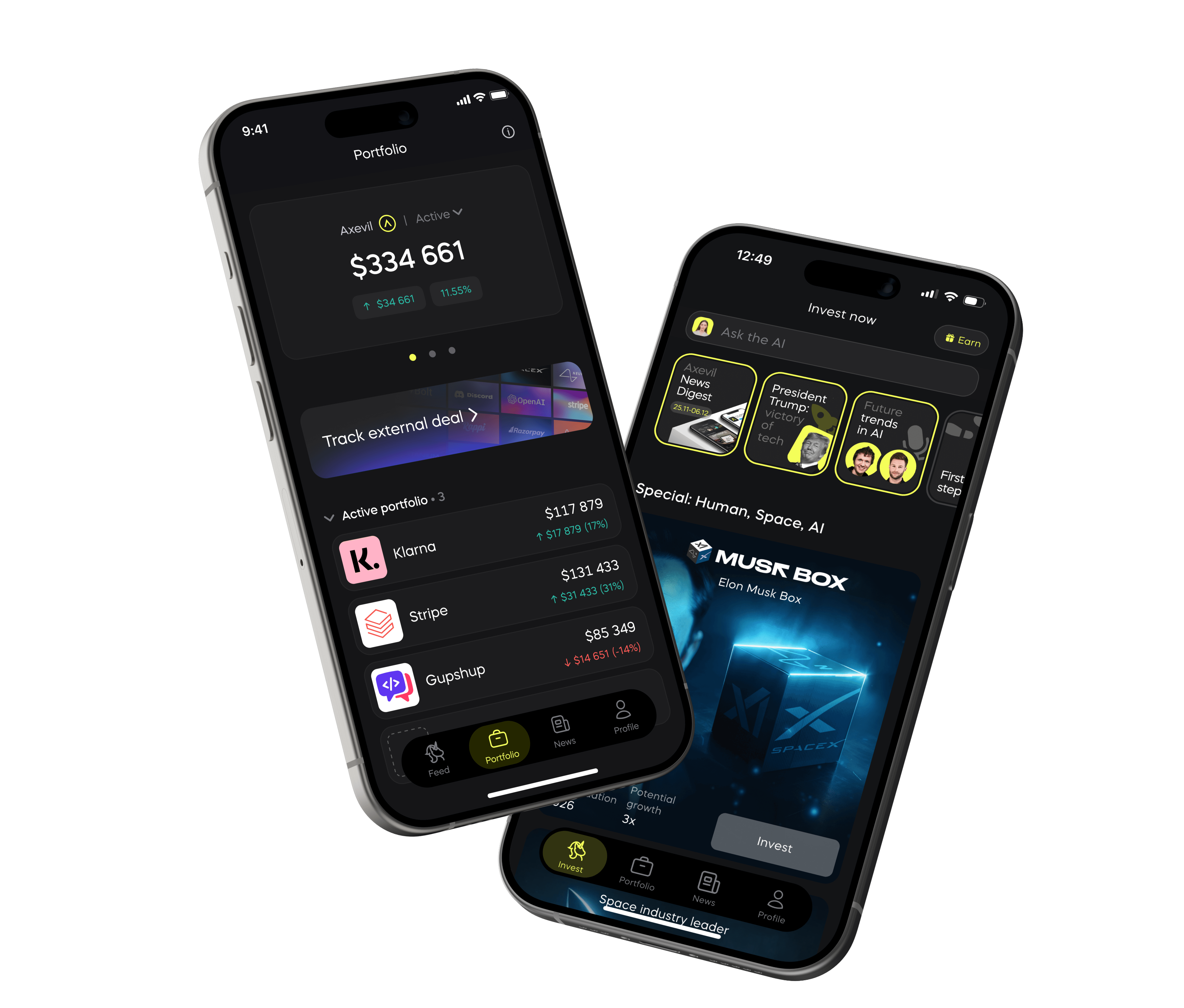

3/ Digital Platform

We've combined venture investing with technology to make the process as simple and convenient as possible:

User-friendly mobile application

Fully digital investment process

Electronic documentation

Venture AI assistant and investment advisor support

Portfolio performance tracking and venture market news

Our Professional Team

Alexander Ivanov

Co-Founder and Managing Partner

Alexander Ivanov

12+ years of investment banking experience. Previously at Finam, Otkritie, and Aton. Led wealth management development initiatives.

Taras Chumachenko

Co-Founder and Managing Partner

Taras Chumachenko

10+ years of experience in alternative investments. Held senior positions at Societe Generale, managing investment products.

Vladislav Solovev

Senior Investment Analyst

Vladislav Solovev

5+ years of experience analyzing companies across private and public markets. Member of Angel Squad, the largest angel investor community in the US.

Andrey Revenko

Chief Commercial Officer

Andrey Revenko

Strategic capital management expert focused on HNW/UHNW segments. Former CEO of Kalinka Middle East (MENA real estate). 10+ years developing private banking at leading investment firms — BCS Ultima, ATON, and Troika Dialog.

Danil Yakovlev

Chief Product Officer

Danil Yakovlev

Product Lead with 10 years of experience in investments and fintech. Specialist in developing digital products for investors, enhancing user experience, and implementing data-driven solutions.

Artem Duz

Chief Technology Officer

Artem Duz

CTO with 15 years of experience across digital agencies, telecommunications, and brokerage firms. Expert in building scalable systems, agile processes, and AI implementation for digital business transformation.

Anna Babak

Chief Operating Officer

Anna Babak

COO with 5+ years of investment banking experience, including Special Situations. Expert in operational infrastructure, risk management, and resource allocation for sustainable growth.

Georgy Manasov

Chief Content Officer

Georgy Manasov

Content creation expert with 7+ years of experience in investments and capital management. End-to-end content development from concept to execution, text to video. Focused on quality and brand strategy alignment.

Pavel Rasputin

Chief Marketing Officer

Pavel Rasputin

Marketing professional with 15+ years of B2B and B2C experience. Helps startups scale and experienced teams optimize performance through deep customer insights and data-driven approaches.

And 25+ dedicated professionals

delivering market-leading service for you and your clients

Alexander Ivanov

Co-Founder and Managing Partner

Alexander Ivanov

12+ years of investment banking experience. Previously at Finam, Otkritie, and Aton. Led wealth management development initiatives.

Taras Chumachenko

Co-Founder and Managing Partner

Taras Chumachenko

10+ years of experience in alternative investments. Held senior positions at Societe Generale, managing investment products.

Vladislav Solovev

Senior Investment Analyst

Vladislav Solovev

5+ years of experience analyzing companies across private and public markets. Member of Angel Squad, the largest angel investor community in the US.

Andrey Revenko

Chief Commercial Officer

Andrey Revenko

Strategic capital management expert focused on HNW/UHNW segments. Former CEO of Kalinka Middle East (MENA real estate). 10+ years developing private banking at leading investment firms — BCS Ultima, ATON, and Troika Dialog.

Danil Yakovlev

Chief Product Officer

Danil Yakovlev

Product Lead with 10 years of experience in investments and fintech. Specialist in developing digital products for investors, enhancing user experience, and implementing data-driven solutions.

Artem Duz

Chief Technology Officer

Artem Duz

CTO with 15 years of experience across digital agencies, telecommunications, and brokerage firms. Expert in building scalable systems, agile processes, and AI implementation for digital business transformation.

Anna Babak

Chief Operating Officer

Anna Babak

COO with 5+ years of investment banking experience, including Special Situations. Expert in operational infrastructure, risk management, and resource allocation for sustainable growth.

Georgy Manasov

Chief Content Officer

Georgy Manasov

Content creation expert with 7+ years of experience in investments and capital management. End-to-end content development from concept to execution, text to video. Focused on quality and brand strategy alignment.

Pavel Rasputin

Chief Marketing Officer

Pavel Rasputin

Marketing professional with 15+ years of B2B and B2C experience. Helps startups scale and experienced teams optimize performance through deep customer insights and data-driven approaches.

And 25+ dedicated professionals

delivering market-leading service for you and your clients

Join Our Partner Program

We collaborate with financial advisors, fund managers, family offices, and investment consultants.

Learn About PartnershipRegulatory Framework

The fund and management company are registered in the United States and regulated by the Securities and Exchange Commission (SEC).Axevil Capital Venture Ecosystem

Axevil Capital

Management Company

Regulated by the SEC with Exempt Reporting Advisor (ERA) status

Ensures transparency and reporting compliance per SEC requirements (#802-126907).

FINRA Member

Axevil Capital files annual reports by March 31st on the FINRA portal (CRD #323970).

Axevil Capital

Management Company

Attracts investors and initiates SPV creation for each deal through Alextar VC, negotiates deal terms with portfolio companies.

Oversees SPV operational compliance, ensuring transparency and investor protection.

Regulated by the SEC with Exempt Reporting Adviser (ERA) status, confirming adherence to reporting and transparency requirements.

Alextar VC LLC

SPV Fund

Regulated by the SEC

Each offering is structured as a private placement under Reg D 506(b) rules with Form D notification filed with the SEC.

Offering information is public and available on the SEC website (verify filings).

Alextar VC LLC

SPV Fund

The fund operates as a Series SPV LLC format, where each SPV is created for a separate investment transaction.

Each SPV holds portfolio company shares owned by investors proportionally to their stakes.

SPVs are isolated from each other and from Axevil Capital, ensuring separate accounting and reduced investor risk.

How Does It Work?

FAQ

We work with accredited investors (U.S. Accredited Investors) as defined by Rule 501(a) of Regulation D. This category includes, in particular:

— Individuals meeting one of the following criteria:

→ Income ≥ $200k for the past 2 years with reasonable expectation for the current year; or

→ Net worth > $1 million (excluding primary residence; may be combined with spouse/spousal equivalent).

— Professional qualifications: Holders of Series 7/65/82 licenses and knowledgeable employees of private funds (for investments in the corresponding fund).

— Entities: Banks/insurance/registered investment companies; trusts/funds/companies with assets > $5 million; entities where all owners are accredited; family offices/clients meeting the criteria.